18 May 2023

A developed market recession in 2023 or 2024 is firmly within the consensus outlook amongst market forecasters. Yet some global asset prices don’t seem to support this view.

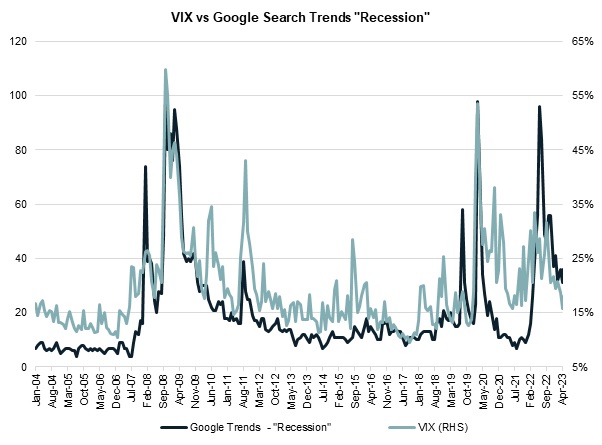

The chart below shows how the VIX index has declined since 2022. The VIX is a measure of near-term implied volatility in the US equity market and gives an indication of the price of buying option protection against sharp equity market moves.

At the same time, the frequency of Google search queries for the term ‘recession’ has declined. While many fund managers and macro strategists remain concerned about the future trajectory of the global economy, option buyers and Google searchers seem to be becoming less worried.

With US equity valuations still elevated and a potential recession looming, this low level of volatility potentially offers an opportunity to purchase cheap downside protection on global equity indices.

Source: Google Trend, Bloomberg

Our Market Snippets email aims to provide concise insight into our investment research process. Each week, we highlight one chart that showcases our research, motivates our current positioning, or simply presents something interesting we’ve discovered in global financial markets.

For more of our current market views, please visit our website.