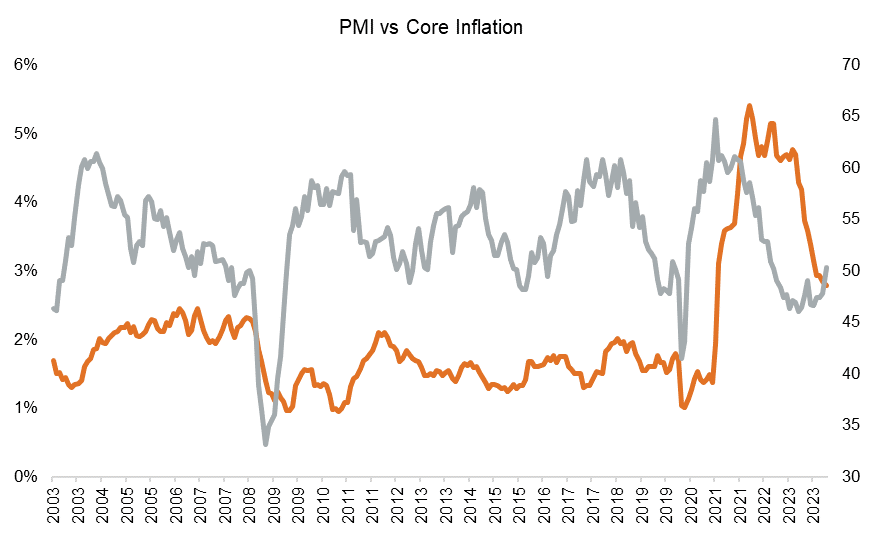

As the fall in US inflation slows and economic growth starts to rebound, the question arises: can inflation continue to cool as growth rebounds? The March US Manufacturing Purchasing Managers Index (PMI) reading moved above 50, indicating expansion. With inflation not yet at the Fed’s target and the economy already reaccelerating, rate cuts could further stimulate growth. How inflationary could this be?

Source: Bloomberg, Federal Reserve

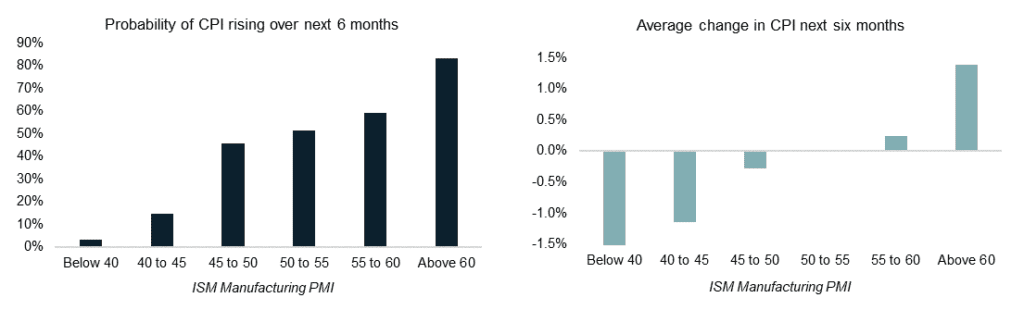

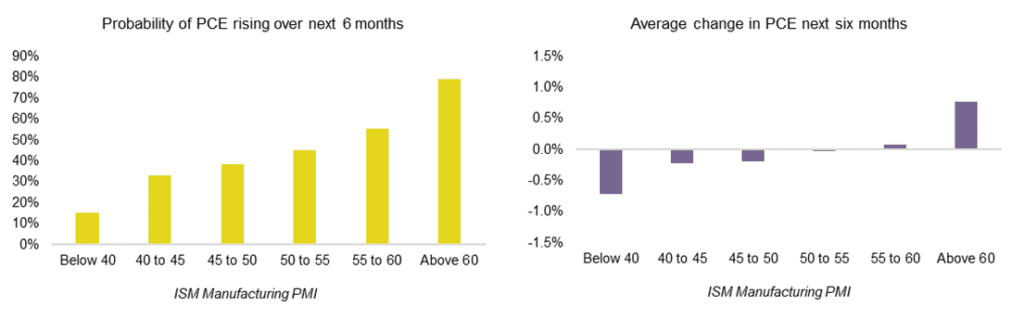

To look at this question, we have compared the US manufacturing PMI to the change in inflation over each subsequent six month period for each monthly PMI reading over the past 50 years.

Source: Bloomberg, Federal Reserve

There is a strong relationship between growth, as measured by the PMI and subsequent changes in inflation, although this relationship mainly occurs at the extremes. This relationship is also stronger when considering headline inflation as opposed to core inflation.

Historically, PMIs of about 50 have, on average, seen the inflation rate stay flat over the subsequent six-month period. This data seems to suggest that growth acceleration is likely to challenge the moderation of inflation towards the Fed’s 2% target.

Currently, this effect may be small, however, if the economic expansion picks up pace and PMIs start moving towards 55 and above, historic experience suggests that it is likely that inflation will reaccelerate.

Our Market Snippets aim to provide concise insight into our investment research process. Each week, we highlight one chart that showcases our research, motivates our current positioning, or simply presents something interesting we’ve discovered in global financial markets.

For more of our current market views, please visit our website.