Mergence was founded in August 2004, and as the 20-year anniversary of our founding approaches, we look back at how the JSE equity market has changed over the past two decades.

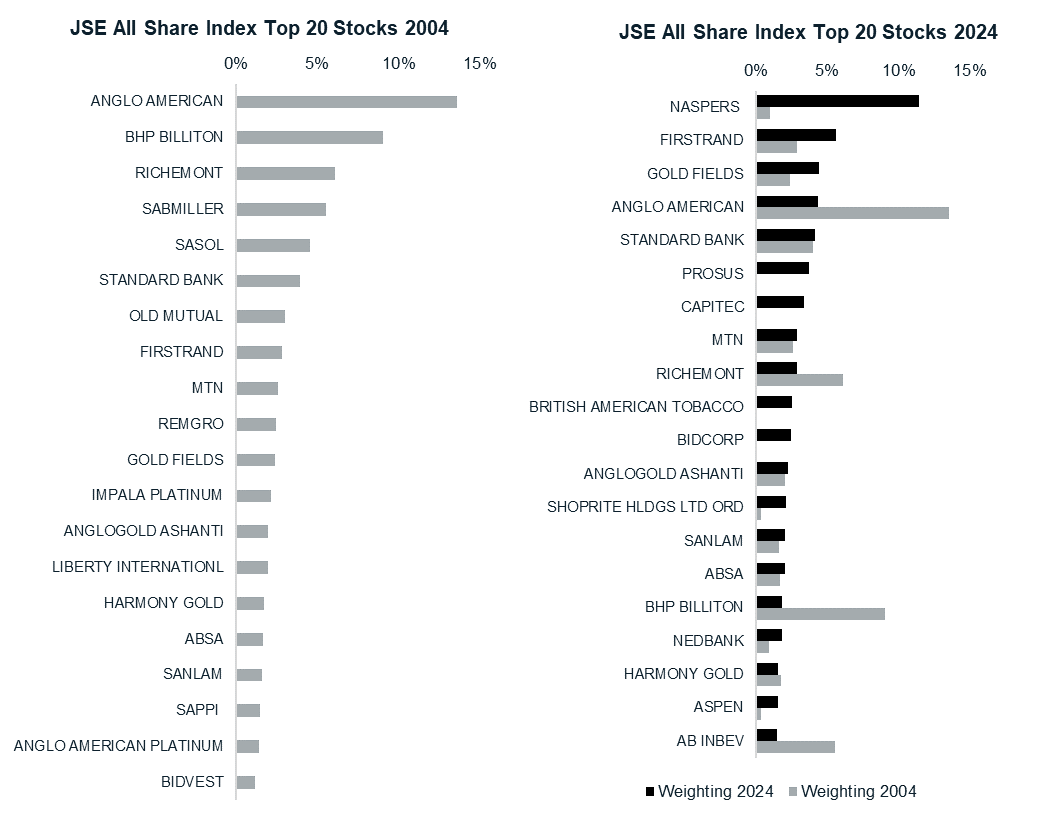

The two charts below show the largest 20 stocks in the JSE All Share Index (ALSI) currently, compared to what they looked like in June 2004.

Source: FTSE/JSE

Of the 20 largest ALSI stocks in 2004, 13 of those stocks are still represented in the largest 20 stocks in 2024 (some of these are subsidiaries, e.g., Bidvest unbundling Bidcorp or takeovers such as SABMiller by AB InBev). The same number for the S&P500 is only six stocks as a number of new high-growth tech stocks have entered the list of the largest stocks in the US over the past two decades.

Of the new entrants in the top 20 of the JSE, the standout performer over this period has been Capitec Bank, growing from a market capitalisation of R427 million and a share price of R6.20 in June 2004 to a current market capitalisation of R268 billion and a share price of R2300.

Naspers has also been a significant winner; what is now the largest stock in All Shares was less than a 1% weight in the index at a share price of R45.80. Not only has Naspers grown to the largest share in the index, it has also given rise to Prosus and Multichoice shares through unbundling.

So, while some of the moves in index weights and market capitalisation over this time have been due to share price performance, multiple other factors could also be driving these changes, such as new share issuance, acquisitions, and unbundling.

For example, Anglo American and BHP Billiton Richemont all have lower weights in the index than in 2004, not because they are smaller companies, but because of the index methodology changes, as the JSE now weights stocks based on only their local shares in issue.

Let’s hope the next 20 years bring more fast-growing companies and interesting new entrants to the JSE.

Our Market Snippets aim to provide concise insight into our investment research process. Each week, we highlight one chart that showcases our research, motivates our current positioning, or simply presents something interesting we’ve discovered in global financial markets.

For more of our current market views, please visit our website.